Tax and Business Articles

Tax regulations are constantly changing, so it is important to keep up to date. This is where I share the latest news.

Changes to HMRC late tax return penalties

At present, the penalties for a late tax return can amount to £1,600... even if you were initially due a repayment of tax but had not submitted the return on time. However, there are plans to change the current system away from the fixed fines and instead adopt a...

Tax accountants in Surrey celebrates 12 years in business

I founded taxhelp.uk.com back in 2006, after building up 17 years' experience in both practice and industry. From working with business owners over a number of years I identified the need for a different type of service: - Specialising in helping the self-employed,...

Changes to HMRC rent a room tax relief

** now CANCELLED in the 2018 October Budget ** There is a very useful tax relief for people who rent out rooms in their own home - the first £7,500 of income is tax-free. However, with the rise of many short-term letting websites HMRC is proposing to change the rules...

Changes to Capital Gains Tax on second properties

At present, when you sell a second property you have some time before the capital gains tax(CGT) is payable. For example, selling a property in July 2018 would fall into the 2018/19 tax return - the tax would not be payable until 31st January 2020. However, from April...

HMRC 31/07/18 Payments on Account

It will shortly be time to make payment of the second HMRC payment on account for 2017/18. There are two payments on account required for 2017/18, the tax year that ended on 5th April 2018. The first was paid by 31st January 2018, and the second is now falling due by...

Incorrect underpayments in tax computations

I have noticed a couple of issues with HMRC 2018 tax computations recently, relating to a figure included for unpaid tax brought forward. In both cases, the clients had an estimated underpayment included in a tax code that changed part way through the 2017/18 year....

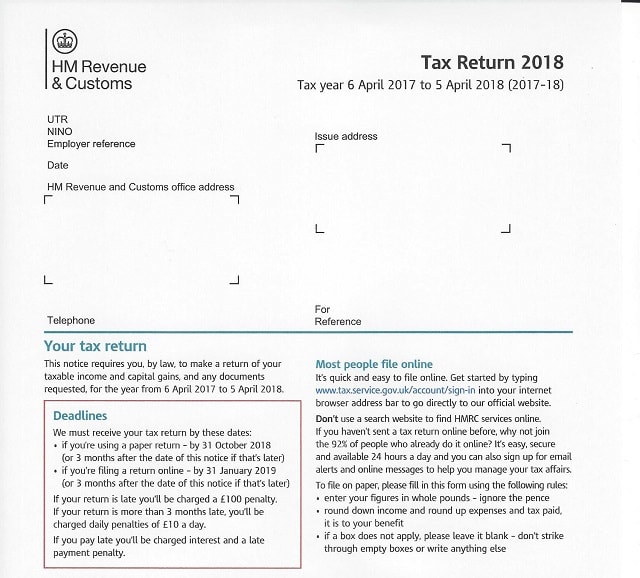

HMRC 2018 Tax Return Form

Now that the 2017/18 tax year has finished, it is time to complete the 2018 tax return. Finding the form online can sometimes be a challenge - the official name for a UK tax return form is a SA100. To obtain the form and the notes, you can obtain these direct from...

Daily fines for a late 2017 tax return are approaching

Although we have now started on completing 2018 tax returns(covering the year to 5th April 2018), there may be some people who have yet to complete the 2017 tax return. This should have been submitted to HMRC by 31st January 2018, so has already incurred a £100 fine...

Watch out for the buy to let mortgage interest changes

People will shortly be completing their 2018 tax returns, which cover the year to 5th April 2018. However, this is the first year where the mortgage interest restrictions introduced last April will apply. In the 2017/18 tax returns, only 75% mortgage interest relief...

Winner at the 2018 Surrey Digital Awards

I'm pleased to announce that taxhelp.uk.com won the Silver award yesterday at the 2018 Surrey Digital Awards in the category 'Use of Social Media for business' sponsored by Barclays. My win follows on from being a finalist in the 2017 awards, as well as winning the...

Planning for 2018 and your tax

With a little over one month to go now in the 2017/18 tax year, it is time to start planning for 2018: 1) Are you going to make any purchases in the business? If so, and you make them before 5th April then you will get tax relief straightaway in the 2018 tax return....

SA302 Tax Computations for Mortgages

In the past, it was common for a mortgage provider to ask for copies of HMRC tax computations (called SA302 forms) for several years to prove earnings. This created an unfortunate problem, as HMRC could only issue these by post due to data concerns. Posting out the...

Finalist in the 2018 Surrey Digital Awards

I am pleased to announce that taxhelp.uk.com has again reached the finals of the Surrey Digital awards in 2018. The Surrey Digital Awards reward innovation and progressive thinking by businesses, individuals, events, charities or educational establishments. Digital...

Last chance to complete your 2017 HMRC tax return

The very final deadline to submit the 2017 tax return to HMRC is rapidly approaching - 31st January 2018. The deadline to have any tax deducted through your tax code in a later year (if possible) has already passed, so you will also now have to pay the tax liability...

Budget 2017 Update

Today saw the 2017 Budget, thankfully some of the possible changes people had worried about were not introduced. VAT Rumours had been circulating that a possible reduction in the VAT registration limit would be announced. Currently the limit is £85000 meaning that...

HMRC tax refunds onto cards

In cases where a refund is due for the year, there is a possibility that this might go back onto a card that was used to pay tax - rather than come as a bank transfer or cheque as requested on the tax return. This is something to be aware of, in case you are waiting...

No tax payments at post offices in future

Unfortunately HMRC will no longer be allowing payments of tax to be made through post offices from 15th December 2017. This is likely to affect those living in the smaller towns the most, as many have seen bank branch closures and were told not to worry, as you could...

HMRC to stop accepting credit cards

There is a good chance that quite a few people will go to pay their tax at the end of January 2018, but only then find out that HMRC has stopped accepting credit cards... From 13th January 2018 it will no longer be possible to pay your tax using a credit card,...

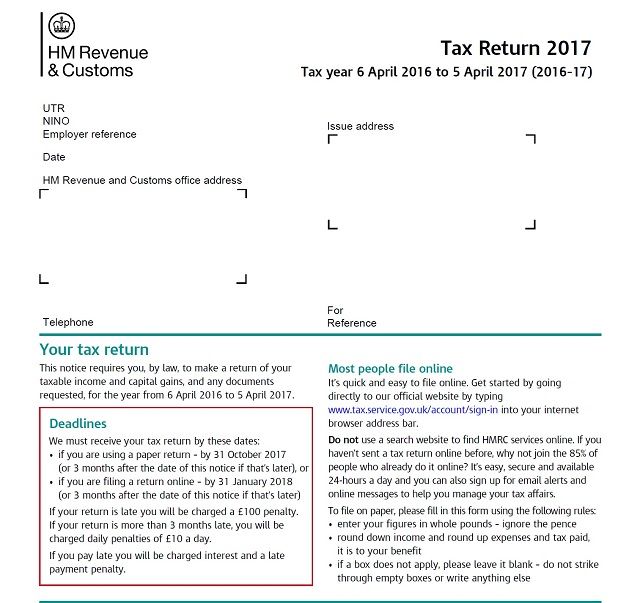

HMRC 31st October 2017 tax return deadline

The 2017 tax return year ended on 5th April 2017 - by now, nearly 6 months has passed since the end of the year so all the information to complete the tax return should be available. 31st October 2017 marks the first tax return deadline for the 2017 returns - although...

HMRC tax code changes for 2017

A useful benefit for those with income taxed at source (pensions or employments) is the possibility of collecting underpaid tax through the tax code (interest free, and by instalments in a later year.) For example, if you had a liability that would have originally...

HMRC October 2017 deadline to register for a tax return

A deadline often missed is the one to register for a tax return should one not already have been issued by HMRC. If you have untaxed income in the year to 5th April 2017, then you must notify HMRC by 5th October 2017 so that a tax return form can be issued for...

HMRC aiming to eliminate cheques

As part of HMRC's ongoing cost-cutting, they have recently stated their aims to eliminate cheques. However, there is a portion of the population who still use cheques regularly so this may take some time. Paying HMRC In the past people would use the HMRC payslip...

taxhelp.uk.com celebrates 11 years in business

It was back in July 2006 that I founded taxhelp.uk.com. Rather than becoming a general accountancy practice, I started the business to specialise in helping small business – usually one person running their own business from home as a sole trader. Instead of the usual...

Good news about Making Tax Digital(MTD)

We have some excellent news - Making Tax Digital(MTD), the coming burden that many self-employed people were unaware of, has been postponed until at least 2020 (and hopefully permanently.) While improving systems and more up-to-date data for small businesses is...

HMRC 31st July 2017 Payments on Account

The end of July marks another tax deadline - for paying the second instalment towards your 2016/17 tax liability. If you are required to make payments on account then these are calculated as 50% of your 2016 tax liability each. The first payment made by 31st January...

Finance Bill Changes

Due to the upcoming election, several sections were dropped from the finance bill so that it could pass through quickly. There are quite a few sections that have been dropped, we will have to wait and see if they are reinstated after the election. The top four...

It’s time to complete your 2017 HMRC personal tax return

Now that the new tax year has started, you can commence preparation of your 2016/17 personal tax return. The 2017 tax return covers income and expenses in the year to 5th April 2017. Although the first deadline isn't until October, preparing the return as soon as the...

Daily fines for a late 2016 tax return are approaching

People may think that the fine for a late 2016 tax return is £100... but in fact it can actually be £1600 or more. The fine applies even if you have a overpayment of tax for the year - it is quite normal to see that tax refund you would have been entitled to disappear...

Time to invest in your business equipment

As the 2016/17 tax year draws to a close on 5th April 2017, now is the time to review whether you should replace any existing equipment. If you purchase new equipment now then you will receive tax relief straightaway in the accounts for the year to 5th April 2017 -...

Dividend tax changes from April 2018

Back in April 2016 the tax on dividends changed, however as the 2017 tax returns have yet to be prepared there is a good chance that a large number of people don't know about the last change - let alone the next one coming in from April next year. In April 2016 people...

Changes to Class 2 and Class 4 National Insurance in 2018

Last week we had details announced about changes to both Class 2 and Class 4 National Insurance, to take effect from April 2018. However, this has now been revised from the National Insurance changes were announced back in March 2016, and were expected to come...

2017 Spring Budget #Budget2017

Yesterday saw the Spring Budget 2017, with several updates affecting the self-employed: Making Tax Digital(MTD) A welcome postponement of the introduction date was announced - for those who are below the VAT threshold, the first time they will have to use MTD will be...

HMRC MTD Update February 2017

We finally have some more details about MTD from HMRC, although some other details are still to be confirmed. Who will be affected by Making Tax Digital(MTD)? At present there are only two groups of people who will be affected: 1) Those with rental profits above...

Missed the 2016 tax return deadline?

2016 tax returns should have been submitted to HMRC by 31st January 2017 - unfortunately returns that have not been submitted will be due to pay a minimum of a £100 fine. In addition, if there is any tax due then interest is already running... To add to the issues,...

taxhelp.uk.com finalist in the 2017 Surrey Digital Awards

The finalists have just been announced for the 2017 Surrey Digital Awards... I'm pleased to announce that taxhelp.uk.com has made the list, for the third year running now. Winners will be announced at a presentation evening on Thursday 9 March at The HG Wells...

Excellent service from Lenovo customer support

For many businesses their computer is important, so being able to get timely support is critical. I recently had call to contact Lenovo with a query - their response timescale far exceeded my expectation... 10:30pm - my initial query was submitted by email 2:20am! -...